The past two years have seen a difficult-to-imagine series of major macro events and responses that are still in the process of playing out. Going into 2020 we had low interest rates and a strong economy. The emergence of the global COVID pandemic resulted in lockdowns and restrictions that in turn led to layoffs and supply chain disruptions. The global policy response was to provide economic stimulus including keeping rates ultra-low and increasing government spending to support affected businesses and workers.

After a sharp initial downturn in growth, the global economy recovered impressively, but the stage was set for a new challenge in the form of sharply rising inflation. The short version is that supply chain disruptions led to shortages in a wide swath of products where demand was high, and when demand outstrips supply, the result is higher prices. At the same time, a shortage of workers led to rising wages as businesses competed to attract and keep workers. That combination – rising wages and rising inflation – can become a self-reinforcing spiral that is damaging to the economy. The Fed (and Central Banks around the globe) recognize this risk and have committed to preventing it by increasing interest rates to whatever extent is required.

Enter the next macro wildcard, which was Russia’s invasion of Ukraine. The war in Ukraine has had wide-ranging, but diverse, impacts on the global economy and individual regions. Besides Ukraine itself, the most direct and damaging economic impact is on Russia (less than 2% of global GDP). However, Russia is a major producer and exporter of oil and natural gas—to Europe in particular, accounting for roughly 50% of Europe’s natural gas imports and 25% of its oil imports—and certain agricultural commodities and base metals. As such, the war and the sanctions imposed on Russia by the West are having, and for the foreseeable future will continue to have, a material impact on global economic growth and inflation. In a nutshell, the war is a “stagflationary” supply-shock: it fuels higher inflation via sharply rising commodity prices (especially oil) while also depressing growth via negative impacts on disposable income and consumer spending.

The path, timing, impact and ultimate outcome of the war remain highly uncertain. As we’ve often said about shocking events such as this: the truth is no one knows, and if they think they know, they’re fooling themselves.

The disheartening events in Ukraine came as the COVID-19 pandemic news was getting better. There has been a recent uptick in new cases globally—in China (leading to full lockdowns in the affected areas under China’s “zero-COVID” approach), other Asian countries and Europe—and the U.S., are seeing a similar uptick in a number of regions. But over time, with continued rising immunity rates, vaccines, medical advancements, and social and business adaptation, the economic damage and disruption should continue to recede.

If so, this should both support economic growth via consumer and business spending and mitigate some of the inflationary pressures the U.S. and global economy experienced last year caused by widespread supply-chain bottlenecks, supply/demand mismatches for consumer durable goods (e.g., autos) and the sub-par recovery in the U.S. labor force participation rate.

That said, Jerome Powell and the Federal Reserve are in a tough spot. They know they need to tighten monetary policy to prevent a wage-price spiral from taking hold. If they fail, it will require even more drastic policy tightening down the road increasing the likelihood of recession. Yet, much of the current inflation is driven by exogenous supply-side disruptions due to COVID and the Ukraine war that the Fed can’t control. Raising rates is intended to crimp aggregate demand and should eventually have a downward impact on inflation. But it also raises the risk of driving the economy into recession.

Our equity positioning remains broadly diversified, including use of active managers who can avoid areas of the market they find unattractive. While fixed income is coming off its worst quarter in decades, we continue to look for opportunities to “make lemonade out of lemons” by way of harvesting tax losses where available, becoming more defensive where warranted and taking advantage of the jump in short-term yields in U.S. Treasuries where it makes sense. For clients where it has been appropriate to have an allocation to alternative strategies, this space has largely had a positive impact so far this year.

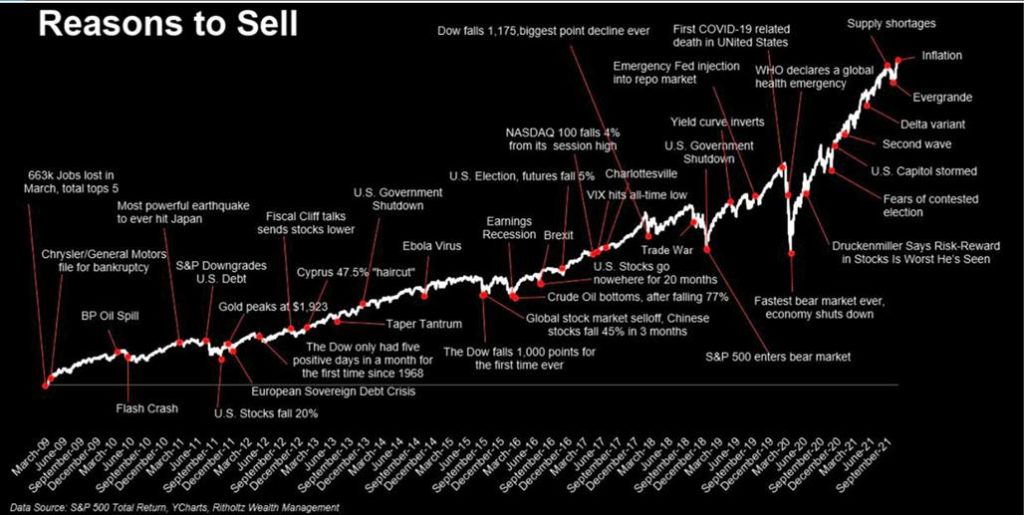

We dislike market declines and periods of high uncertainty as much as anyone, but both are an inevitable part of investing. While uncomfortable, these stretches remind us of the fundamental principles that define our approach: invest for the long term because the short term cannot consistently be predicted, stay disciplined, diversify, and remember that disruption creates investment opportunities for those with the conviction to take advantage of them. As always, we appreciate the trust that our clients place in us to guide their investments through both volatile and steady times. We leave you with an interesting graphic, “Reasons to Sell” for some additional context. Please contact your Isaacson team directly with any questions or concerns.